Page 135 - TGIA_AnnualReport2010

P. 135

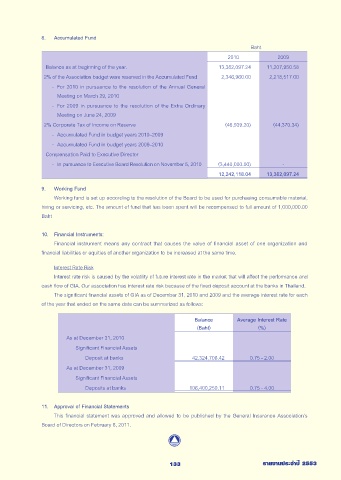

8. Accumulated Fund

Baht

2010 2009

Balance as at beginning of the year. 13,382,097.24 11,207,950.58

2% of the Association budget were reserved in the Accumulated Fund 2,346,960.00 2,218,517.00

- For 2010 in pursuance to the resolution of the Annual General

Meeting on March 29, 2010

- For 2009 in pursuance to the resolution of the Extra Ordinary

Meeting on June 24, 2009

2% Corporate Tax of Income on Reserve (46,939.20) (44,370.34)

- Accumulated Fund in budget years 2010–2009

- Accumulated Fund in budget years 2009–2010

Compensation Paid to Executive Director

- In pursuance to Executive Board Resolution on November 5, 2010 (3,440,000.00) -

12,242,118.04 13,382,097.24

9. Working Fund

Working fund is set up according to the resolution of the Board to be used for purchasing consumable material,

hiring or servicing, etc. The amount of fund that has been spent will be recompensed to full amount of 1,000,000.00

Baht

10. Financial Instruments:

Financial instrument means any contract that causes the value of financial asset of one organization and

financial liabilities or equities of another organization to be increased at the same time.

Interest Rate Risk

Interest rate risk is caused by the volatility of future interest rate in the market that will affect the performance and

cash flow of GIA. Our association has interest rate risk because of the fixed deposit account at the banks in Thailand.

The significant financial assets of GIA as of December 31, 2010 and 2009 and the average interest rate for each

of the year that ended on the same date can be summarized as follows:

Balance Average Interest Rate

(Baht) (%)

As at December 31, 2010

Significant Financial Assets

Deposit at banks 42,324,706.42 0.75 - 2.00

As at December 31, 2009

Significant Financial Assets

Deposits at banks 106,400,250.11 0.75 - 4.00

11. Approval of Financial Statements

This financial statement was approved and allowed to be published by the General Insurance Association’s

Board of Directors on February 8, 2011.

133 รายงานประจำปี 2553

_11-0038(092-133)E.indd 133 3/9/11 7:32:31 AM