Page 135 - TGIA_AnnualReport2012

P. 135

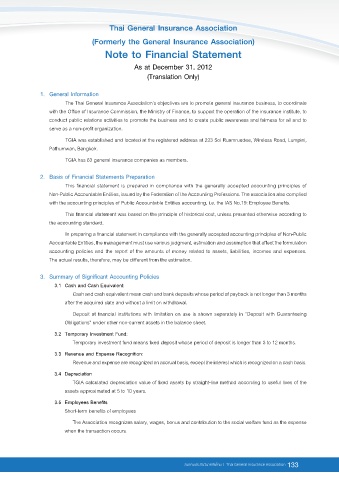

Thai General Insurance Association

(Formerly the General Insurance Association)

Note to Financial Statement

As at December 31, 2012

(Translation Only)

1. General Information

The Thai General Insurance Association’s objectives are to promote general insurance business, to coordinate

with the Office of Insurance Commission, the Ministry of Finance, to support the operation of the insurance institute, to

conduct public relations activities to promote the business and to create public awareness and fairness for all and to

serve as a non-profit organization.

TGIA was established and located at the registered address at 223 Soi Ruamruedee, Wireless Road, Lumpini,

Pathumwan, Bangkok.

TGIA has 63 general insurance companies as members.

2. Basis of Financial Statements Preparation

This financial statement is prepared in compliance with the generally accepted accounting principles of

Non-Public Accountable Entities, issued by the Federation of the Accounting Professions. The association also complied

with the accounting principles of Public Accountable Entities accounting, i.e. the IAS No.19: Employee Benefits.

This financial statement was based on the principle of historical cost, unless presented otherwise according to

the accounting standard.

In preparing a financial statement in compliance with the generally accepted accounting principles of Non-Public

Accountable Entities, the management must use various judgment, estimation and assumption that affect the formulation

accounting policies and the report of the amounts of money related to assets, liabilities, incomes and expenses.

The actual results, therefore, may be different from the estimation.

3. Summary of Significant Accounting Policies

3.1 Cash and Cash Equivalent:

Cash and cash equivalent mean cash and bank deposits whose period of payback is not longer than 3 months

after the acquired date and without a limit on withdrawal.

Deposit at financial institutions with limitation on use is shown separately in “Deposit with Guaranteeing

Obligations” under other non-current assets in the balance sheet.

3.2 Temporary Investment Fund:

Temporary investment fund means fixed deposit whose period of deposit is longer than 3 to 12 months.

3.3 Revenue and Expense Recognition:

Revenue and expense are recognized on accrual basis, except the interest which is recognized on a cash basis.

3.4 Depreciation

TGIA calculated depreciation value of fixed assets by straight-line method according to useful lives of the

assets approximated at 5 to 10 years.

3.5 Employees Benefits

Short-term benefits of employees

The Association recognizes salary, wages, bonus and contribution to the social welfare fund as the expense

when the transaction occurs.

สมาคมประกันวินาศภัยไทย | Thai General Insurance Association 133