Page 135 - TGIA_AnnualReport2014

P. 135

The liabilities of the post employment benefits of TGIA employees comprise current value of post

employment benefits obligations less unrecognized historical service cost and gains and losses from un-

recognized actuarial projection.

In complying with the IAS 19: Employee Benefits for the first time in 2011, the TGIA chose to recognize

the liabilities during a changing period in which was higher than the recognized value of liabilities on the

same date according to the former accounting policy by adjusting the record with accumulated gains on a

beginning date of the year 2011.

3.5 Revenue and Expense Recognition

Revenue and expense are recognized on accrual basis, except the interest which is recognized on a

cash basis.

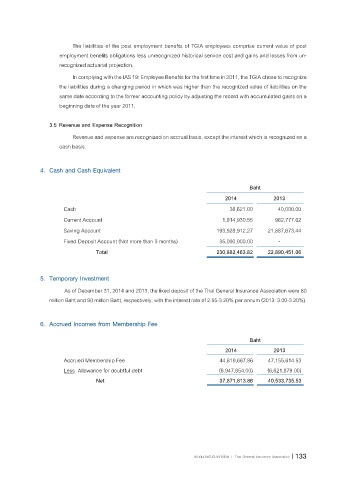

4. Cash and Cash Equivalent

Baht

2014 2013

Cash 38,621.00 40,000.00

Current Account 1,914,930.55 962,777.62

Saving Account 193,928,912.27 21,887,673.44

Fixed Deposit Account (Not more than 3 months) 35,000,000.00 -

Total 230,882,463.82 22,890,451.06

5. Temporary Investment

As of December 31, 2014 and 2013, the fixed deposit of the Thai General Insurance Association were 80

million Baht and 90 million Baht, respectively, with the interest rate of 2.55-3.20% per annum (2013: 3.00-3.20%).

6. Accrued Incomes from Membership Fee

Baht

2014 2013

Accrued Membership Fee 44,819,667.86 47,155,614.53

Less Allowance for doubtful debt (6,947,854.00) (6,621,879.00)

Net 37,871,813.86 40,533,735.53

สมาคมประกันวินาศภัยไทย | Thai General Insurance Association 133