Page 95 - TGIA_AnnualReport2011

P. 95

The flood disaster that occurred at the end of 2011 has caused Thailand’s GDP to grow only by 1.5%,

compared with 7.8% in 2010. Many industrial sectors were badly affected, especially those whose plants are

located within the 7 industrial parks in Ayudhaya and Pathum Thani provinces where homes, shops and

communication infrastructure were affected.

In the first 10 months of 2011, the general insurance business, especially miscellaneous insurance still

continued to grow higher than any year in the past. Crop and personal accident insurance also grew more than

the previous year. This reflected the fact that the public is more conscious about their health and lives. The growth

was also driven by the government’s program to promote main rice crop insurance project. However, motor

insurance still remained the main sector in general insurance with the market share of 59.5%. The total premium

income of general insurance in a period between January to October of 2011 was 115,585 million Baht or

an increase of 14.47% against the same period of 2010.

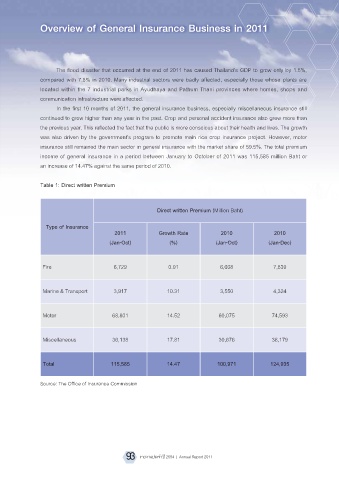

Table 1: Direct written Premium

Direct written Premium (Million Baht)

Type of Insurance

2011 Growth Rate 2010 2010

(Jan-Oct) (%) (Jan-Oct) (Jan-Dec)

Fire 6,729 0.91 6,668 7,839

Marine & Transport 3,917 10.31 3,550 4,324

Motor 68,801 14.52 60,075 74,593

Miscellaneous 36,138 17.81 30,676 38,179

Total 115,585 14.47 100,971 124,935

Source: The Office of Insurance Commission

93