Page 98 - TGIA_AnnualReport2012

P. 98

Overview of General Insurance Business in 2012

Despite the public debt crisis in Europe and the fiscal cliff situation in the US, the economy of Thailand and

others in ASEAN region at the end of the year 2012 still continued to grow strongly and steadily. The condition

should help promote ASEAN economy to play a major role in world economy in the future. According to the

projection of the Organization for Economic Co-operation and Development (OECD), the average growth rate of

ASEAN economy in a period between 2013-2017 will be about 5.5%. The main driving factor of the growth is

domestic demand.

In a 10 month period of 2011, the general insurance business in Thailand continued to grow, especially in

miscellaneous insurance whose growth was 39.14%, the highest of all insurance categories, as a result of a strong

expansion in property risk and other miscellaneous insurance. This growth shows that the industries are more aware

of the various kinds of risks that may affect their businesses. Moreover, the government’s policy to provide excise

tax deduction to first-time car buyer also attributed to an increase in direct premium income in motor insurance

section in the end of the year 2012. Motor insurance still maintained the largest market share. During a period from

January to October of 2012, the total direct premium income was 85,013 million Baht or an increase of 23.56%,

compared with the same period of 2011, as shown in Table 1.

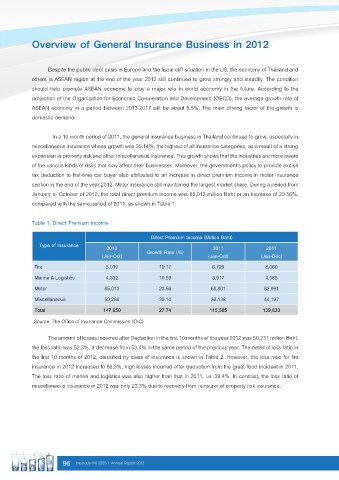

Table 1: Direct Premium Income

Direct Premium Income (Million Baht)

Type of Insurance 2012 2011 2011

(Jan-Oct) Growth Rate (%) (Jan-Oct) (Jan-Dec)

Fire 8,019 19.17 6,729 8,060

Marine & Logistics 4,332 10.59 3,917 4,585

Motor 85,013 23.56 68,801 82,991

Miscellaneous 50,286 39.14 36,138 44,197

Total 147,650 27.74 115,585 139,833

Source: The Office of Insurance Commission (OIC)

The amount of losses Incurred after Deduction in the first 10 months of the year 2012 was 50,231 million Baht,

the loss ratio was 52.3%, a decrease from 53.4% in the same period of the previous year. The detail of loss ratio in

the first 10 months of 2012, classified by class of insurance is shown in Table 2. However, the loss ratio for fire

insurance in 2012 increased to 88.3%, high losses incurred after deduction from the great flood incident in 2011.

The loss ratio of marine and logistics was also higher than that in 2011, i.e. 39.4%. In contrast, the loss ratio of

miscellaneous insurance in 2012 was only 23.3% due to recovery from reinsurer of property risk insurance.

96 รายงานประจ�าปี 2555 | Annual Report 2012