Page 98 - TGIA_AnnualReport2013

P. 98

Overview of Non-life Insurance Business in 2013

In 2013, Thai economy had been volatile, causing many agencies in both public and private sectors to revise

the projections of Thai economic growth rate throughout the year. There were several incidents having impacts to

the Thai economy such as the Fed’s announcement to slow down the Quantitative Easing measure seeing a sign of

recovery of the US economy, the political unrest in late 2013 after the government dissolved the parliament for a

general election and the anti-government protesters demanded the caretaker government to resign.

Bank of Thailand reported the Business Sentiment Index (BSI), which continually declined to 45.0, and the

Private Investment Index, which shrank by 8.1% in December 2013 because entrepreneurs had postponed invest-

ment to reassess the economic and political situations.

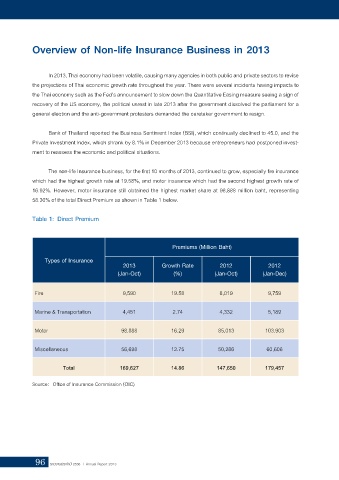

The non-life Insurance business, for the first 10 months of 2013, continued to grow, especially fire insurance

which had the highest growth rate at 19.58%, and motor insurance which had the second highest growth rate of

16.92%. However, motor insurance still obtained the highest market share at 98,888 million baht, representing

58.30% of the total Direct Premium as shown in Table 1 below.

Table 1: Direct Premium

Premiums (Million Baht)

ประเภท

Types of Insurance

2013 Growth Rate 2012 2012

(Jan-Oct) (%) (Jan-Oct) (Jan-Dec)

Fire 9,590 19.58 8,019 9,759

Marine & Transportation 4,451 2.74 4,332 5,189

Motor 98,888 16.29 85,013 103,903

Miscellaneous 56,698 12.75 50,286 60,606

Total 169,627 14.86 147,650 179,457

Source: Office of Insurance Commission (OIC)

96 รายงานประจำาปี 2556 | Annual Report 2013