Page 99 - TGIA_AnnualReport2013

P. 99

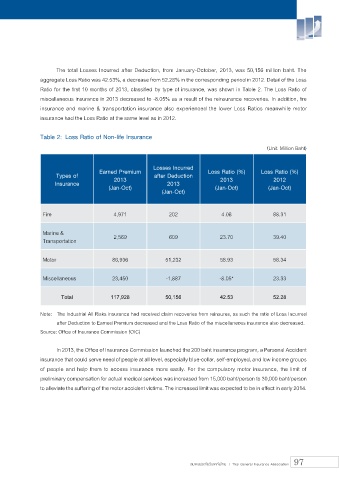

The total Losses Incurred after Deduction, from January-October, 2013, was 50,156 million baht. The

aggregate Loss Ratio was 42.53%, a decrease from 52.28% in the corresponding period in 2012. Detail of the Loss

Ratio for the first 10 months of 2013, classified by type of insurance, was shown in Table 2. The Loss Ratio of

miscellaneous insurance in 2013 decreased to -8.05% as a result of the reinsurance recoveries. In addition, fire

insurance and marine & transportation insurance also experienced the lower Loss Ratios meanwhile motor

insurance had the Loss Ratio at the same level as in 2012.

Table 2: Loss Ratio of Non-life Insurance

(Unit: Million Baht)

Losses Incurred

Earned Premium Loss Ratio (%) Loss Ratio (%)

Types of after Deduction

Insurance 2013 2013 2013 2012

(Jan-Oct) (Jan-Oct) (Jan-Oct)

(Jan-Oct)

Fire 4,971 202 4.08 88.31

Marine & 2,569 609 23.70 39.40

Transportation

Motor 86,936 51,232 58.93 58.34

Miscellaneous 23,450 -1,887 -8.05* 23.33

Total 117,928 50,156 42.53 52.28

Note: The Industrial All Risks insurance had received claim recoveries from reinsures, as such the ratio of Loss Incurred

after Deduction to Earned Premium decreased and the Loss Ratio of the miscellaneous insurance also decreased.

Source: Office of Insurance Commission (OIC)

In 2013, the Office of Insurance Commission launched the 200 baht insurance program, a Personal Accident

insurance that could serve need of people at all level, especially blue-collar, self-employed, and low income groups

of people and help them to access insurance more easily. For the compulsory motor insurance, the limit of

preliminary compensation for actual medical services was increased from 15,000 baht/person to 30,000 baht/person

to alleviate the suffering of the motor accident victims. The increased limit was expected to be in effect in early 2014.

สมาคมประกันวินาศภัยไทย | Thai General Insurance Association 97