Page 99 - TGIA_AnnualReport2014

P. 99

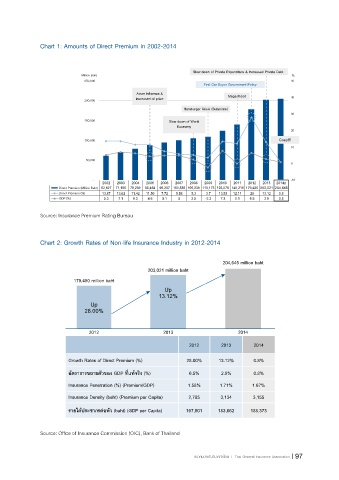

Chart 1: Amounts of Direct Premium in 2002-2014

Slow down of Private Expenditure & Increased Private Debt

Million Baht %

250,000 50

First Car Buyer Government Policy

Avian Influenza & Mega Flood

200,000 increased oil price 40

Hamburger Crisis (Subprime)

30

150,000 Slow down of World

Economy

20

100,000 Coup!!!

10

50,000

0

- -10

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014p

Direct Premium (Million Baht) 62,627 71,160 79,289 88,454 95,287 100,888 106,239 110,173 125,075 140,219 179,480 203,021 204,645

Direct Premium (%) 13.87 13.62 11.42 11.56 7.72 5.58 5.3 3.7 13.53 12.11 28 13.12 0.8

GDP (%) 5.3 7.1 6.3 4.6 5.1 5 2.5 -2.3 7.8 0.1 6.5 2.9 0.8

Source: Insurance Premium Rating Bureau

Chart 2: Growth Rates of Non-life Insurance Industry in 2012-2014

204,645 million baht

203,021 million baht

179,480 million baht

Up

13.12%

Up

28.00%

2012 2013 2014

2012 2013 2014

Growth Rates of Direct Premium (%) 28.00% 13.12% 0.8%

อัตราการขยายตัวของ GDP ที่แทจริง (%) 6.5% 2.9% 0.8%

Insurance Penetration (%) (Premium/GDP) 1.58% 1.71% 1.67%

Insurance Density (baht) (Premium per Capita) 2,785 3,134 3,155

รายไดประชากรตอหัว (baht) (GDP per Capita) 167,501 183,662 188,373

Source: Office of Insurance Commission (OIC), Bank of Thailand

สมาคมประกันวินาศภัยไทย | Thai General Insurance Association 97