Page 100 - TGIA_AnnualReport2014

P. 100

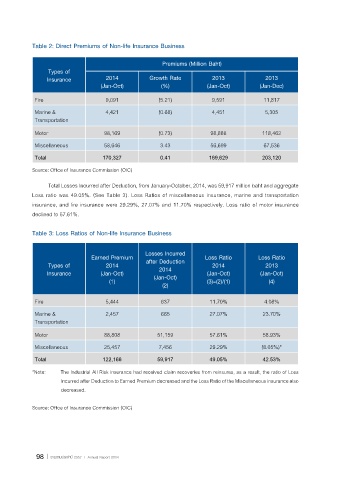

Table 2: Direct Premiums of Non-life Insurance Business

Premiums (Million Baht)

Types of

Insurance 2014 Growth Rate 2013 2013

(Jan-Oct) (%) (Jan-Oct) (Jan-Dec)

Fire 9,091 (5.21) 9,591 11,817

Marine & 4,421 (0.68) 4,451 5,305

Transportation

Motor 98,169 (0.73) 98,888 118,462

Miscellaneous 58,646 3.43 56,699 67,536

Total 170,327 0.41 169,629 203,120

Source: Office of Insurance Commission (OIC)

Total Losses Incurred after Deduction, from January-October, 2014, was 59,917 million baht and aggregate

Loss ratio was 49.05%. (See Table 3). Loss Ratios of miscellaneous insurance, marine and transportation

insurance, and fire insurance were 29.29%, 27.07% and 11.70% respectively. Loss ratio of motor insurance

declined to 57.61%.

Table 3: Loss Ratios of Non-life Insurance Business

Losses Incurred

Earned Premium Loss Ratio Loss Ratio

Types of 2014 after Deduction 2014 2013

2014

Insurance (Jan-Oct) (Jan-Oct) (Jan-Oct) (Jan-Oct)

(1) (3)=(2)/(1) (4)

(2)

Fire 5,444 637 11.70% 4.08%

Marine & 2,457 665 27.07% 23.70%

Transportation

Motor 88,808 51,159 57.61% 58.93%

Miscellaneous 25,457 7,456 29.29% (8.05%)*

Total 122,166 59,917 49.05% 42.53%

*Note: The Industrial All Risk insurance had received claim recoveries from reinsures, as a result, the ratio of Loss

Incurred after Deduction to Earned Premium decreased and the Loss Ratio of the Miscellaneous insurance also

decreased.

Source: Office of Insurance Commission (OIC)

98 รายงานประจำาปี 2557 | Annual Report 2014